Estudio Alfa is a technology company dedicated to offering services that promote the image of companies and brands on the Internet, including the development of apps. To carry out these services, they use techniques and strategies that comply with usability standards and favour positioning in search engines, thus helping their clients' websites to receive more visitors and thus potential clients. They also have special experience in the production and tourism sectors.

ASEDIE (the Multisectoral Information Association) has just published a new edition of its Infomediary Sector Report, which analyses the real, economic and social value of companies reusing data from the public and/or private sector to develop value-added products. The presentation took place at an event at the National Geographic Institute, in which the Data Office also participated.

This year is special because the report is in its 10th edition. Throughout these years, the different reports have shown the growth and consolidation of the sector. Specifically, for this edition, 701 companies have been identified, which represents a growth of 58% compared to the first report, produced in 2013. However, the figure is very similar to that already analysed in 2021.

This year's edition is subtitled "Data Economy in the Infomediary". The data economy already plays a major role in European production ecosystems and is expected to continue to grow: by 2025, it is estimated that it will contribute 4% of GDP.

In this context, ASEDIE has set among its objectives not only to promote the infomediary sector and the Data Economy, but also to contribute to raising public awareness of its benefits. To this end, it has prepared this report with various indicators that show the impact of the sector.

Main findings of the report

Below is a breakdown of the main conclusions drawn from the report:

- The 10th edition of the report shows a turnover of more than €2 billion, offering employment to almost 23,000 professionals.

- 44% of the infomediary companies surveyed use AI to create value-added products or as a tool. 72% of respondents claim to use both public and private data for the creation of their products and/or services. On the other hand, 17% of the companies indicate that they only use private information compared to 11% that only use public data.

- There are 3 sectors that continue to account for most of the activity, with geographic information standing out. The majority of infomediaries specialise in "geographic information" (24%), "market research" (20%) and the "economic and financial" sub-sector (19%).

- Only two of the subsectors account for almost half of total sales (49%): "Geographic information" and "Economic and financial". However, "Publishing", despite being the 6th sector in terms of number of companies, is the one with the highest average sales (€6M) and median (€917,000). Regarding the latter, it practically doubles the next most important sector ("Directoriales"), which has a value of around €503,000, well above the rest of the sectors.

- Most of the companies are located in the Community of Madrid (38%), Catalonia (13%) and Andalusia (11%). As in previous years, the Infomediary Sector is represented in all the Autonomous Communities.

- 71% of the infomediary companies have been created less than 20 years ago. Of these, 36% are between 11 and 20 years old and 35% are less than 10 years old. The average age continues to be 16 years, with the Publishing subsector being the oldest and the Tourism subsector the youngest.

- The average number of employees per company in the Infomediary Sector is 43, reaching 22,638 employees. As in turnover, the subsector with the highest figure is "geographic information" with 30% of the total.

- The aggregate subscribed capital reached 273,789,439 €, which represents a decrease of 12.2% with respect to the previous edition. Furthermore, the three most capitalised subsectors are "market research", "economic and financial" and "geographic information".

- The net profit generated this year exceeds 110 million euros, which represents a slight decrease compared to the previous year. "Culture" and "Directories" were the only two sub-sectors whose companies did not make a positive profit this year.

- The report identifies the opening of new public sources, the digitisation of the public sector and the interoperability of sources as the main challenges to be addressed. The updating and quality of information are some of the barriers to access and reuse of information.

- 94% of respondents see the creation of the Data Office as an opportunity for the geospatial sector. They expect this body to help in the coordination, centralisation and integration of data, and to promote openness and homogenisation of the availability of public sources.

Top 3 ASEDIE and success stories

The report includes a review of the status of the Top 3 Asedie, ASEDIE's initiative to promote the complete opening of three datasets by all Autonomous Communities, following unified criteria that facilitate their reuse. In 2019, the opening of the Cooperatives, Associations and Foundations databases was proposed. The initiative was a success, and all Communities have now opened at least two of the three proposed databases. This initiative is included in Commitment 9 of the 4th Open Government Plan.

Given the good reception, a new Top 3 was launched in 2020, aimed at those Autonomous Communities that had already opened the first three databases, so that they could continue to advance in the opening of new datasets relating to: Register of Energy Efficiency Certificates, Industrial Estates and SAT Registers (Agricultural Transformation Companies). The evolution in the opening of these databases in the last year has also been remarkable, as shown in the following image.

The report concludes with several success stories of infomediary companies and examples of the products and services they produce, such as Infoempresa's web browser extension for obtaining business information or Axesor's platform (Investiga Pro) that allows online consultation of the Real Property Databases of both the Commercial Registry and the General Council of Notaries.

The report is available on Asedie's website in Spanish together with the video of the presentation of the report. It will soon be available in English together with an executive summary in French and Portuguese.

In conclusion, the sector is in good health, but this year has shown a slight decrease of 4.6% in times of pandemic. However, these figures are above the Spanish average (Spain's GDP fell by almost 10% in the same period). Although 55% of respondents have noticed the effect of Covid-19 on companies' or citizens' access to their data, the fact that 92% of respondents say they are satisfied with the level of digitisation available to them gives hope for improved results in the near future.

Open data can be very useful in promoting aspects such as the health and well-being of citizens or the protection of the environment, as well as the growth of economies. The opening of information encourages innovation, the creation and adaptation of companies and organizations around services and technologies capable of generating profitability and offering solutions to current problems from the reuse of data.

But, in addition, economic data contributes to many organizations being able to make better decisions. Economic statistics and indicators allow us to know how a certain market or country evolves, discover trends and act accordingly.

If you are interested in accessing this type of data, below, we collect 10 examples of repositories related to the economy at an international level:

-

Publisher: World Bank

This is a website belonging to the World Bank. This platform offers a complete range of economic data that are frequently updated and allows access to open information produced by the World Bank itself. Among the type of data it offers are international debt statistics, world development indicators or databases on household consumption patterns around the world, among many others.

Two interesting sections stand out. One is its data catalog, where you can find information on economic topics such as statistical performance indicators or data on COVID-19, for example. Another is its microdata section, which offers a collection of datasets from the World Bank and other international, regional and national organizations.

Much of this data are offered in the most popular formats (HTML, JSON, PDF, CSV, ...). In addition, it has a space for reusers, with information on APIs.

-

Publisher: IMF (Internationaly Monetary Fund)

This portal contains IMF datasets on global financial stability, regional economics, global financial statistics, economic outlook, and more. Data can be downloaded in various formats, including XLSX and XLS.

-

Publisher: OECD (Organisation for Economic Co-operation and Development)

The OECD data catalog has a classification by sector, including the economic sector. It offers the possibility of filtering data according to whether or not they have access to the API. In addition, this portal allows queries to be made on large databases in its OECD.Stat data warehouse.

Particularly interesting are its data visualizations, such as these developed to show information about global employment rates, as well as other employment-related indicators.

-

Publisher: UNECE (United Nations Economic Commission for Europe)

On its public information portal, you can find various datasets, mostly economic, linked to the different countries of Europe. It also offers other datasets on population and transport and some alternative resources such as visualizations or data maps.

The data is displayed in four different forms: graphs, rankings, tables and maps. In this example, information about the global youth unemployment rate can be queried through the 4 means mentioned above. The data can be downloaded in CSV, TSV or JSON.

-

Publisher: Economic Commission for Latin America and the Caribbean (CEPAL, United Nations).

This portal brings together databases and statistical publications, as well as economic datasets for Latin America and the Caribbean, often accompanied by other resources such as data visualizations or maps. It also provides access to these data through an API to speed up and facilitate the data search process for its users. Data can be downloaded in XML, JSON or XLXS.

-

Publisher: ECB (European Central Bank)

The ECB, in collaboration with the national central banks and other national (statistical and supervisory) authorities of the European Union, offers a service for the development, collection, compilation and dissemination of statistics in open format.

The Statistical Data Warehouse provides indicators for the euro area, including in some cases national level breakdowns. Each of the statistics offered on this portal has a brief introductory description of the topics covered. All data are available for download in Excel and CSV format.

-

Publisher: World Trade Organisation (WTO).

The World Trade Organisation (WTO) is an international organisation that deals with the rules governing trade between countries. Its main objective is to help producers of goods and services, exporters and importers to conduct their activities in an optimal way.

The organisation offers access to a selection of relevant databases providing statistics and information on different trade-related measures. This information is classified in four main blocks: goods, services, intellectual property, statistics and other topics, making it easier for users to search for data.

On this page you can consult the WTO online systems (databases/websites) that are active. Some of them require registration.

UNIDO Statistics Data Portal

-

Publisher: United Nations Industrial Development Organization (UNIDO).

UNIDO is a specialised agency of the United Nations that promotes industrial development for poverty reduction, inclusive globalisation and environmental sustainability.

It publishes, among other things, datasets on industrial development, manufacturing production and investment. On its website, it has a search engine for information on indicators such as population growth or GDP growth by country. These data can be visualised through a graph that is updated with the selected information, also offering the possibility of comparing data from different countries within the same graph.

By accessing the DataBase section, each dataset can be downloaded in excel and CSV format.

UNCTADSTAT

-

Publisher: UNCTAD (United Nations Conference on Trade and Development)

UNCTAD is an organisation charged with helping developing countries harness international trade, investment, financial resources and technology to achieve sustainable and inclusive development.

On its open data portal, it collects statistical series by country and product, with a special focus on countries with developing and transition economies. Digital economy, international trade in services, maritime transport or inflation and exchange rates are just some of the topics that can be consulted on this platform.

In addition, for users who are not used to navigating this type of portal, UNCTAD provides a series of video tutorials that introduce the user to the data centre and show, among other things, how to export information from the platform (downloadable in CSV or XLSX).

-

Publisher: IDB (Inter-American Development Bank)

The Inter-American Development Bank (IDB) is an inter-national financial organisation whose main objective is to finance viable economic, social and institutional development projects and promote trade integration in Latin America and the Caribbean.

In its data section, it offers country development indicators related to the macroeconomic profile, global integration and social prospects of each country. Moreover, in this section you can find some additional resources such as graphs and visualisations that allow you to filter the information according to different indicators or courses to increase your economic knowledge based on the data.

Most of the data can be downloaded in CSV, JSON or RDF.

This has been just a small selection of data repositories related to the economic sector that may be of interest to you. Do you know of any other relevant repositories related to this field? Leave us a comment or send us an email to dinamizacion@datos.gob.es

The new edition of the Report on the Infomediary Sector by ASEDIE (Multisectoral Information Association), which analyzes the real, economic and social value of companies that reuse data from the public and / or private sector to develop value-added products.

In the 9th edition of this report, 700 companies have been analyzed, showing a stable sector. Specifically, in 2019 the Infomediary Sector grew by 6.4%, an evolution above that of the Gross Domestic Product, which was 3.4%.

In addition, it provides data on how infomediary companies closed 2019 with a sales volume of more than 2,543 million euros and offering employment to almost 22,000 employees.

Below, we break down the main conclusions drawn from the report:

- 3 sectors continue to concentrate most of the activity, highlighting geographic information. Most infomediary companies are specialized in “geographic information” (24%), “market studies” (21%) and the “economic and financial” subsector (18%).

- Half of the subsectors account for 85% of total sales. Highlights Especially the Geographic Information with more than 600 million euros of turnover (23.6%).

- 61% of the infomediary companies consulted use AIto create value-added products or as a tool. 70% of those surveyed affirm that they also reuse the data for internal use, compared to 30% who indicate that the use is exclusively external.

- More than half of the companies are located in the Community of Madrid (38%), Catalonia (13%) and Andalusia (11%). As in previous years, the Infomediary Sector is represented in all the Autonomous Communities.

- Almost 40% of the companies in the Sector have been created in the last 10 years. The average seniority is 16 years, with the Publishing subsector being the oldest and the Tourism subsector being the youngest.

- The average number of employees per company in the Infomediary Sector amounts to 37, until reaching 21,988 workers. As with billing, the subsector with the highest figure is “geographic information” with 30.5% of the total.

- The aggregate subscribed capital exceeds 310 million euros, almost 11 million more than in the previous edition. In addition, the three most capitalized subsectors are "market studies", "economic and financial" and geographic information.

- All subsectors have 65% or more of companies in profits. As in previous years, the net profit generated has exceeded 125 million euros.

- Data analysis and the opening of new databases stand out this time as the main challenges of the Infomediary Sector, closely followed by Digitization. On the other hand, the lack of a “data culture” and the low quality of data are some of the barriers that hinder the access and reuse of information.

The report includes a review of the situation of the Top 3 Asedie, ASEDIE's initiative to promote that all Autonomous Communities fully open three data sets -Cooperatives, Associations and Foundations -, following unified criteria that facilitate their reuse. At the moment, there are already 15 Communities that have opened at least two of the three proposed databases.

The document concludes with several success stories of infomediary companies and examples of the products and services they produce, such as the Infoempresa directory of innovative companies in Spain or the use that Iberimform is doing IBM Watson.

The reportIt is available on the Asedie website in Spanish and English, and will soon be in French. Also available is report presentation video.

In conclusion, we are facing a sector in good health, which shows outstanding growth. Although 74% of those surveyed believe that the pandemic will directly affect the evolution of the Sector this year, the fact that 96% of those surveyed use data to create their value-added products or services makes them confident in positive long-term prospects.

Data has become central to our increasingly digitised economies and societies. The five largest companies in the S&P500 index (Apple, Microsoft, Amazon, Facebook and Alphabet) all have data as the primary foundation underpinning their businesses. Together they account for approximately a quarter of the index's total capitalisation. This gives a clear picture of the weight of data in today's economy. The global volume of data is expected to grow from 33ZB (ZettaBytes - a 1 followed by 21 zeros) in 2018 to 175ZB in 2025. By then it is also expected that up to 75% of the world's population will be living with data on a daily basis, with an average of one data interaction per person every 18 seconds.

On the other hand, and due to the spread of the COVID-19 pandemic that started last year, we have witnessed a prolonged transition in our most day-to-day activities from physical to digital interactions in education, business, government and family settings - which will surely lead to this expected growth in the data universe taking hold, but also to an increasing societal demand for services that make respectful and responsible use of data. In addition, the European Commission's recovery plan in response to the pandemic will provide the largest financial investment ever made by the European Union, with nearly 2 trillion of investment over the next few years. Within this plan, the largest package of investment foreseen will be aimed at fostering innovation and digitisation in Europe. This, together with the strategic and regulatory framework that is being put in place, will only consolidate and even accelerate these trends in our continent.

Already a few months ago, in this particular and decisive context in which we find ourselves, the World Economic Forum (WEF) invited us to reflect on the new paradigms of innovation and business that are emerging around the way we relate and interact with technology and data. The idea is to also take this opportunity to rethink the current business models around information in order to experiment and start using data more fairly and creatively.

New areas of innovation

These new emerging opportunities would still be based primarily on creating value through data, but would also be characterised by being more respectful of consumer data, enabling more trusting relationships between all actors involved and where all would benefit from the end result. The WEF classifies these opportunities into four main groups:

- New areas of value creation: using the knowledge gained through data and new technologies emerging in its environment to find new sources of revenue and to incorporate new products and services, as well as to provide richer information to a wider range of stakeholders, while ensuring privacy and security.

A good example of how these new value areas are emerging is how Airbus has been able to expand its market beyond its traditional customer base through the new geospatial product services it provides through its new subsidiary UP42, serving as an intermediary between its traditional geospatial data providers and new customers with their own geospatial data needs.

- New business models: reinventing and proposing collaboration models that enable new use cases, always focusing on the consumer in order to respond to their basic needs while generating trust.

A nearby example in this field is BBVA's data-driven banking strategy. This strategy is based on the concept that data belongs to the customer and it is the customer who decides how to manage it. To this end, they have created a platform through which other external collaborators can access this data in a secure and consensual manner and thus offer a range of additional services that the bank could not provide on its own.

- Enriched experiences: using data to better understand their own employees as well as their partners and customers, thus being able to offer more personalised products and services and a more complete and enriching experience.

This is the case of Digi.me, a platform where users can voluntarily collect their personal, financial and health data, and then share it according to their own interests. In this way, companies get a unique and reliable source of data and in return, users receive compensation in the form of products or services, while maintaining control over their own privacy at all times.

- Improved decision making: identifying which business process optimisations can lead to better streamlining of internal processes to achieve further reductions in operating costs.

For example, Aera Technology is a company that combines big data, machine learning and artificial intelligence to develop supply chain automation. It provides real-time data on demand, supply, production and inventory performance through a simple search interface that directly asks questions in natural language.

Collaborative, respectful and sustainable

In this environment of increasing dependence on data, the world is preparing for a paradigm shift in the use of data by business. The new approaches that emerge must be responsible with the use of data, as well as respecting the baseline regulations on data protection, pursuing not only economic benefit but also the creation of value for individuals and society as a whole. Companies now have the opportunity and the imperative to rethink their current models, to start using data more creatively and to experiment with new forms of monetisation, thus becoming trusted custodians of data. The key to success will be the creation of collaborative ecosystems that enable the participation of all stakeholders and pursue a change in current systems for the co-creation of value through data in a sustainable and respectful way.

The WEF has already taken a first step in collaboration with more than 50 companies from 20 countries through its recent pioneering Data for Common Purpose Initiative (DCPI), focused on designing a flexible data governance framework to exploit the societal benefit of data.

Content prepared by Carlos Iglesias, Open data Researcher and consultan, World Wide Web Foundation.

Contents and points of view expressed in this publication are the exclusive responsibility of its author.

Infomediary activity is not classified as such in the CNAE. Therefore, the census of companies must be updated through indirect and ad hoc actions. Periodically, the National Observatory of Telecommunications and the Information Society (ONTSI) analyzes the state of this sector and collects the results in a report, which this year reaches its fifth edition.

Under the title "From Infomediary Sector to Economy Data. Characterization of the Infomediate Sector", this year's report starts from a new approach, more aligned with the European Union's vision. The document highlights that the infomediate sector is evolving towards the data economy, and takes as a reference the words of the European Commission, which defines "data companies" as "organizations whose main activity is to produce products, services and technologies related to data".

A sustainable sector in continuous growth

This year's report shows us that we are facing a sector that does not stop growing in a sustainable way. 708 companies have been identified, 32% more than in 2016. It is worth noting that the businesses that are created around this activity last over time, since 63.7% of the companies analyzed are more than 10 years old. The sector is mainly concentrated in Madrid, where more than 50% of the companies are located. It is followed by Catalonia, with 18.4%.

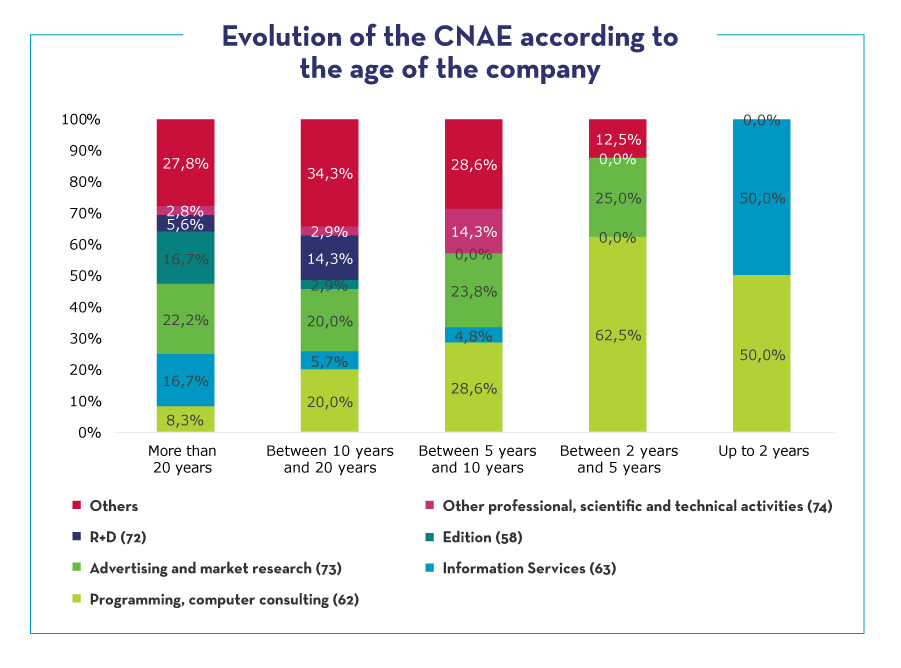

In recent years there has been an evolution towards businesses centred on digital technologies: the most recent companies are mainly in the field of programming and IT consultancy and information services.

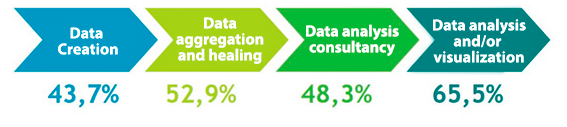

73.5% of the companies carry out more than one infomediaries activity, although the one that attracts more business in data analysis and/or visualization.

Almost 50% of these companies are micro-enterprises (with less than 10 employees) and only 6% have more than 250 employees. The turnover of the sector, however, is not negligible, estimated to reach 1,987 million euros in 2018, 15.4% more than in 2015. Of this volume, 718 million come from the reuse of information.

With regard to employment, in recent years there has been significant growth. The sector employs between 14,000 and 16,000 people, 14.3% more than in 2016. If we focus only on employees linked to data reuse, the growth is even more spectacular, 61.5%, reaching 7,700-8,400 workers.

Traditionally, the distribution of employment by gender in the infomediate sector has been equal (49.9% women and 50.1% men). However, the progressive introduction of digital technologies is breaking this parity in favor of men. Newer (and more technological) companies have many more men than women on their staff.

1 in 5 companies uses data from public sources

More than 80% of the companies analyzed use data from public sources to develop these services, which are combined with private data in 69.9% of the cases. The most demanded public information belongs to the fields of trade, environment, economy and demography. They mainly access this data in non-proprietary structured formats (csv, xml), although it is worth noting that there are still many suppliers that provide their data without structure (pdf, jpg), making it difficult to process automatically.

When asked about the data they most miss, the companies surveyed indicated that they would like to have more data on weather, real-time transport, tourism, demographics (with information disaggregated at the level of census sections), justice at the regional and local level, the public sector, the economy and the treasury.

These are just some of the report's conclusions, but there are many more. You can download the full report and its presentation below.

We have been talking about the digital transformation for years, but perhaps it has been in the last few months when we have had to stay at home and resort to teleworking or e-commerce, that we have noticed the need for it the most. Many companies have had to transform quickly, adapting their internal processes, their relationship with customers and even their business models to new needs.

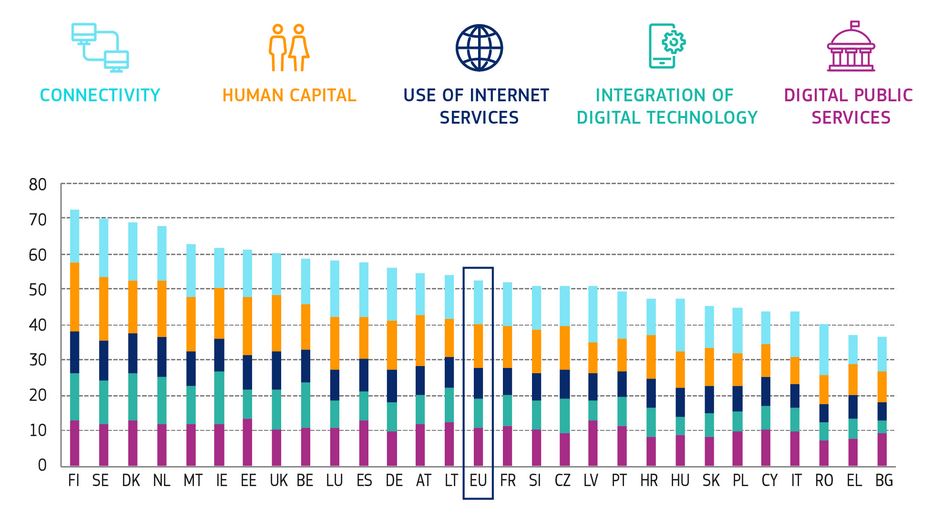

However, the digital transformation is nothing new, and before the health crisis there were already many organizations with a long way to go. This is reflected in the Digital Economy and Society Index (DESI), which each year measures the performance and evolution of the EU Member States in terms of digital competitiveness.

DESI INDEX

The DESI Index performs its analysis based on 5 indicators: Digital Public Services, Connectivity, Human Capital, Integration of Digital Technology and Use of Internet Services.

In this index, Spain is above the European Union average, occupying the eleventh position, with unequal scores in the various markers:

- The score where our country stands out the most is Digital Public Services, where it is in second place in Europe, improving its position with respect to last year, thanks to the application of a default digital strategy throughout its central administration. One of the indicators driving Spain's position in this dimension is open data, where we are in second place in terms of maturity in Europe. We are also above average in the availability and use of e-government services.

- Spain also performs well in the area of connectivity (5th place), driven by the good implementation of high-speed networks: 80% of households have fiber optic coverage, well above the EU average (34%).

- In contrast, Spain is below the EU average in the human capital indicator (16th place), with 43% of people between 16 and 74 years of age still lacking digital skills. It does improve on last year's percentage of ICT graduates and specialists in total employment. The report highlights the government's efforts to improve this situation, with actions such as the Strategic Plan for Vocational Training in the Education System 2019-2022, which seeks to create forty new degrees in different ICT fields.

- With regard to the integration of digital technology, Spain ranks 13th, in line with the EU average. Spanish companies take advantage of the opportunities offered by digital technologies and are above Europe in the use of electronic information exchange systems (43% compared to 34%), although slightly below in access to macrodata analysis (11% compared to 12) and the use of the cloud (16% compared to 18%). With regard to emerging technologies, the report highlights that Spain has developed a significant number of coordination measures, especially in the field of cyber security.

- Finally, the use of Internet services has increased since the previous year, and the country has obtained results above the EU average. However, it is worth mentioning that it is still used more for leisure activities (consuming multimedia content), than for day-to-day business, such as banking or e-commerce.

The study was carried out before the pandemic, so the results do not include the actions carried out in recent months, such as the publication of the Digital Agenda 2025, which includes the promotion of a Data Economy. The measures to be developed include the implementation of an Artificial Intelligence Strategy, the development of a Data Office with a Chief Data Officer at the head and the creation of an Artificial Intelligence Advisory Council, among others.

OTHER REPORTS ON DIGITAL TRANSFORMATION IN SPAIN

In addition to the DESI index, in recent months two reports of particular importance when it comes to digitalization have been published in our country: the "Digital Society in Spain Report 2019" and the "COTEC 2020" report.

Digital Society in Spain 2019 Report

This report, published by the Telefónica Foundation, includes data and indicators that describe the state of Spanish society in relation to the media, uses and digital services. Specifically, it focuses on the deployment of telecommunications infrastructure, the level of implementation of the most advanced technologies and the state of the art of Spanish digital life.

The conclusions of the report are very much in line with the DESI index, which it takes as a reference. It highlights that 9 out of 10 inhabitants are Internet users, and that the gender gap in cyberspace has been completely eliminated, although an age gap still exists. The report also highlights that our country has a very good connection, with ultra-fast network coverage in three out of every four homes.

The study indicates that the main technological currents that are shaping the digital transition in Spain revolve around artificial intelligence, industry 4.0 and cyber security, with the first one standing out above all: while in 2013 only one out of every fifty emerging companies focused its activity on artificial intelligence, now one out of every twelve do so.

The report ends with an analysis of the degree of digital development presented by the Autonomous Communities, describing the current situation and the challenges facing each region.

You can read the full report at this link.

COTEC 2020 Report

The COTEC report, on the other hand, focuses on a fundamental aspect to boost the digital transformation: the R&D+I. The report shows us the innovation map in Spain, through the analysis of the main indicators and national, regional and international strategies.

The report analyzes data from 2018 and shows that R&D has gained weight in the productive structure for the second consecutive year, driven mainly by private investment. However, we are still far from countries like France, Italy or Germany.

The autonomous communities maintain heterogeneous levels of effort. The five most advanced regions are the Basque Country, Madrid, Navarre, Catalonia and Castile and Leon).

The report also focuses on education, where it highlights that Spain has a higher rate than the European average in STEM graduates, but with a much wider gender gap than in most surrounding countries. It should be noted that our country has a low proportion of people with an average educational level, since we have a high rate of population that leaves school at an early age, and a high percentage of young people who graduate from university.

You can read the full report at this link.

After taking a look at these reports, we can conclude that both the public and private sectors are making an effort to promote the digital transformation of Spain in order to make the digital transformation and innovation a driver of economic and social development in our country. There are still areas for improvement, but there is no denying the interest in tackling the challenges ahead.

The third edition of the EU Dathaton 2019 has come to an end. 99 projects were presented, and 12 was selected to pitched their project at the final of this competition, which seeks to promote the use of open data in EU countries to generate new ideas, products and innovative services in 3 categories:

- Challenge 1: 'Innovative ideas through open data'. Participant developed innovative ideas using open data and combined with other open or private data sources.

- Challenge 2: 'New insights in economics and finance'. Participants had to develop a new perspective, concept or business model through open data.

- Challenge 3: 'Tackling climate change', aimed at the creation of new concepts or business models that help fight against climate change using open data.

Among the 12 finalists, we could find two Spanish proposals: EnvyRState, which finish in the fourth position in Challenge 2, and The Blue Time Machine (BTM), which win the second prize in Challenge 3.

- EnvyRState is a project of the University of Castilla La Mancha, presented by Emilio López Cano. EnvyRState uses open data from Eurostat and the European Central Bank, among other sources. It is a web tool, interactive and dynamic, that allows to visualize and analyze different effects of the real estate market in the environment. This project includes heat maps and charts, and continuously updates conclusions about the real estate market.

- The Blue Time Machine (BTM), presented by Paula Camus, researcher at IH Cantabria, is a digital representation of the past, present and future conditions of our "blue planet". Its objective is to better understand our environment to deal with climate change. For this, it uses data from Copernicus and EMODnet.

Both projects were presented at a final act in Brussels, on June 13, where a jury chose the winners of each category:

- Challenge 1. The first prize went to the Smartfiles Network, an Austrian network that aims to make national and EU jurisprudence accessible from any PDF. The second and third prize went to Euromaps, a Belgian platform that uses maps to tell stories with data about Europe, and Politicindex, a German platform that summarizes the promises and achievements of politicians and allows users to compare and filter.

- Challenge 2. EconCartography, a map that shows the European economies and identifies their growth opportunities, elaborated by an Italian team, won the first prize. The second prize went to Investment Info, a Finnish application that uses and compiles investment and macroeconomic data to provide an overview of the investment atmosphere and make forecasts; while the third prizes went to Bizmap, a French decision-making tool that allows small and medium-sized companies to visualize the most economically attractive regions of the EU for international expansion.

- Challenge3. The winner was the Greek team creator of Chloe Irrigation Systems, a platform that monitors and optimizes irrigation systems using artificial intelligence to reduce water waste and increase crop yields. The second place went to the Spanish The Blue Time Machine (BTM), and third place went to the Belgian MindYourFoot, a Belgian tool that aims to achieve reductions in carbon emissions through awareness and advice.

The 3 teams that won the competition received €15,000 each, the second prize was €7,000 and the third prize € 3,000.

All information about the competition at: https://publications.europa.eu/en/web/eudatathon

ASEDIE (Multisector Information Association) has published a new edition of the Infomediary Sector report, which analyses the real, economic and social value of companies reusing both public and private data to create value-added products.

The number of companies analysed on this occasion was 697, 35 more than in the previous edition. It should be noted that the financial information used for sales and employees corresponds to fiscal year 2017, because 2018 information was not yet available.

The main conclusions of the report are:

- 97% of Infomediary companies use open data from the public sector. In addition, three of four combine this information with private data. In this context, it is not surprising that 83% of surveyees believe that the opening of databases and access to them for reuse is apriority for the sector's evolution.

- More than 50% of the companies are located in the Community of Madrid (37%) and Catalonia (18%). However, the Infomediary Sector is represented in all the Autonomous Communities, with the exception of the Autonomous Cities of Ceuta and Melilla.

- 3 sectors continue to concentrate most of the activity. Most infomediary companies specialize in "geographic information" (22%), "market research" (21%) and the "economic & financial" subsector (20%).

- A sustainable sector, but with a large number of new companies. 60% of the companies analyzed have more than 10 years and almost one third (29%) exceeds twenty - as a curiosity, the oldest company dates from 1947-. But it is also a sector that attracts new actors, since 31% of companies have been created in the last 5 years.

- Turnover increased by 5.4% compared to the previous year. Specifically, the aggregated turnover in the Infomediary Sector is € 1,796,778,748. This figure is very positive, although it should be noted that most of the turnover is concentrated in a few big companies.

- And the number of employees increased by 4.6%, reaching 20,229 workers. These data are very positive, since national full-time employment was 2.9%.

- The aggregate subscribed capital of the sector exceeds 300 million euros. After two consecutive years of decline, the aggregate subscribed capital has experienced a 10% growth in this year, although it is lower than 2016.

- 70% of companies present benefits. 70% of the companies present an average profit of approximately 300,000 euros, with the average loss of the remaining 30% being similar, but with a negative sign. As in previous years, the net profit generated has exceeded 62 million euros.

- Low commercial risk. The probability risk estimated for a company over the last 12 months is moderate or minimum for 74% of companies.

- Data analysis and Big Data stand out again as the main challenges of the Infomediary Sector, followed very closely by the opening of new information sources. On the other hand, the barriers for reuse most mentioned by the surveyees are the different data availability between Autonomous Communities and City Councils.

The report ends by showing a series of success stories in infomediary companies, as re-users, and public sector, as open data publishers.

In short, we are facing a sector with good health, which has experienced a remarkable growth, and with positive prospects for the future: more than half of the surveyees (65%) estimate that the Infomediary Sector will grow over the course of this year, specifically 64% of them estimate the growth to be between 2-5%.

For the tenth consecutive year, Asedie organizes a new edition of the "International Conference on the Reuse of Public Sector Information". The appointment will take place on October 23 at the headquarters of the Spanish Agency for Data Protection in Madrid.

As the previous years, the main objective is to serve as a platform to share knowledge and experiences, coming together all those involved in the Information and Data Community, as well as to promote public-private collaboration for public interest.

Under the motto, "Information, an essential resource for economic development", experts will address the importance of Infomediary sector and the evolution of information access and reuse.

Agenda

The event will begin at 9:45, with a few words from the Asedie President, D. Dionisio Torre. Then, Mr. Carlos Romero, Counsellor of Industry, Telecommunications and Audiovisual, Mr. Jesús Rubí, Deputy to the Director of the Spanish Data Protection Agency, and Barbara Ulbaldi, Head of OECD Digital Government and Open Data Policies Team, will share their vision on the challenges and opportunities of the infomediary sector, paying special attention to sector regulations.

After the coffee break, a round table entitled "The implementation of Reuse and its evolution in the last 10 years" will take place. Mrs. Cristina Morales, General Deputy Director of Information Society Content from the Ministry of Economy and Business, Jorge Salazar, Coordinator of the Commercial Registry from the Registrar College, Mr. Pedro Vivas, Head of the IDE / SIG Support Area of the Ministry of Development, and Mr. Enrique Crespo, Chief of the Information Access Service of the city of Madrid.

The event will conclude with the presentation of the Asedie Award. Since 5 years, Asedie present this award with the aim of highlighting the work of those people, companies or institutions that have done the best work or the greatest contribution to innovation and development of the Infomediary Sector.

Inscription

Admission is free, but places are limited. Therefore, those interested in attending the conference must register before October 18 through this online form.