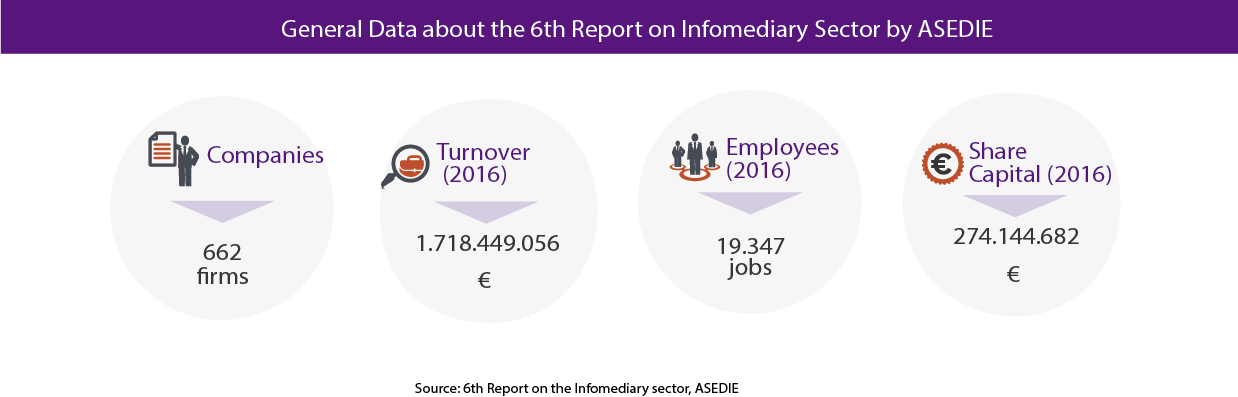

For the sixth consecutive year, ASEDIE (Multisectorial Information Association) has presented a new edition of its report on the infomediary sector. Its objective is to favor the opening of databases and to know the real economic and social value that this sector brings to society. To that end, 662 companies have been analyzed, 26 more than in the 2017 edition. The report analyzes the 2016 data, comparing the result with the previous edition of the report.

Among the novelties of this year, we can find new analyzes and indicators, such as the average turnover per employee or profit and loss analysis, and the monitoring of information requests at Autonomous Communities level. In addition, a specific survey has been conducted to more than 50 infomediary companies, to find out about their vision of the challenges and opportunities of the sector. The report also include success stories that can be used as a guide to optimize the reuse of open data from public organizations.

Some of the main conclusions of the report are:

- Lack of knowledge about what an infomediary is. Despite the fact that 80% of the surveyed companies share that the use and treatment of information affects their business, only 39% considered themselves as being an Infomediary Company. ASEDIE defines infomediary companies as those who “create value-added products and services with data from both the private and public sector, which help in the decision-making”

- The number of companies increased. In 2017, 21 companies ceased their activity, while 47 new companies were incorporated. The main reason for these inactivities is the company’s own commercial extinction, above mergers or defaults

- Three sectors concentrate most of the activity. Whitin infomediary sector, the main subsectors are geographic information (23.0%), market research (22.5%) and economic and financial activities (20.8%).

- Madrid and Catalonia, the favorite locations. The sector is represented in all the Autonomous Communities, except for the Autonomous Cities of Ceuta and Melilla. As happened last year, most of the infomediary companies are concentrated in the community of Madrid (36%) and Cataluña (18%), followed by other communities, such as por Andalucía (8%), Galicia (7%) and the community of Valenciana (7%).

- Turnover increases by almost 2%. According to the annual accounts available in the Mercantile Registry, the sector turn over close to 1,720 million euros in 2016. This figure represents an increase of 1.9%, comparing with the previous year and an average turnover of 2.9 million of euros (although the median is 194,698 euros, due to 15 companies concentrate close to 50% of turnover).

- The number of employees working in infomediary companies remains stable. In 2016, the infomediary companies employed 19,347 personnel, a figure similar to 2015 (19,362). In addition, the average turnover per employee reached 88,822 euros.

- Subscribed capital decreases. At the end of 2017, the subscribed capital, that is, the shares acquired by the shareholders, was 274 million euros, compared to 366 million euros in 2016, which represents a reduction of -25% per year, for the second consecutive year. 83% of the capital is concentrated in 4 subsector: “Market research”, “Geographic Information”, “Economic & Financial” and “Publishing”.

- A sector with benefits. 68% of analyzed companies presented benefits in 2016, which highlights the economic opportunities of information reuse to create value added products and services.

- Big Data and data analysis, the main challenges. Due to the increase in volume and diversity of the data that must be analyzed by infomediary companies, it is not surprising that 55% of the companies surveyed consider Big Data and data analysis as their main challenges.

- Need for greater homogenization in data. The lack of a common database makes users have to go to the different platforms enabled by Autonomous Communities or local authorities. The infomediaries surveyed consider this fact one of the main barriers to the information reuse. In addition, they indicate that they would need more complete, up-to-date and easily accessible information, as well as regulations that will facilitate and encourage reuse.

Although there are still Challenges to be overcome, such as the greater homogenization of the data or the attraction of Big Data talent, the conclusions of the report show us an encouraging future. The majority of respondents (69%) consider that the informadiary sector will have a positive economic growth during the coming years. The increase in the turnover in2016 and the fact that most of the infomediary companies present benefits seem to point in this same direction, positioning the infomediary sector as one of the drivers of the economic growth of our country.